This report is part of PERSPECTIVES, a comprehensive look into the world of prime residential real estate. Access the full report here to discover the latest trends and dynamics shaping the market.

Switzerland is home to some of the most expensive cities on the planet. In 2023, Zurich, its largest city, tied with Singapore for the No. 1 spot as the world’s priciest city. Geneva, its second largest, tied with New York City at No. 3, according to a recent Forbes story.

The country experienced an overall real estate market decline in the volume of transactions in 2023. The 38% dip was down from 2021, a record year, and a 25% decrease when compared with the average number of sales over the last decade.

“In 2023 we have seen a paradoxical dynamic where the market has clearly slowed down due to the increase in interest rates, but prices kept increasing due to a strong demand and limited [inventory], yet at a slower pace than in previous years,” says Quentin Epiney, founder of the real estate firm FGP Swiss & Alps.

The ultra-luxury-home category, however, remained strong in Switzerland last year, Epiney says.

Lower-priced markets slowed because of buyers’ dependence on mortgages (even though interest rates were 2.1%), but that wasn’t true for high-net-worth buyers. The ultra-wealthy continued to flock to the country as a hedge against political and/or economic instability in the world.

“The country is perceived as a safe haven due to the security, stability—both political and financial—and quality of life it has to offer, even if the cost of life is high and there are limitations to property acquisition by foreigners,” Epiney says.

Switzerland’s high-end home market includes Geneva and Zurich, banking and diplomatic centers where high-standard apartments start at US $3 million (CHF 2.64 million) and houses at US $6 million (CHF 5.28 million). In the tourist hot spot of Lake Lucerne, the same standard of property starts at US $2 million (CHF 1.76 million) for an apartment and US $4 million (CHF 3.52 million) for a villa.

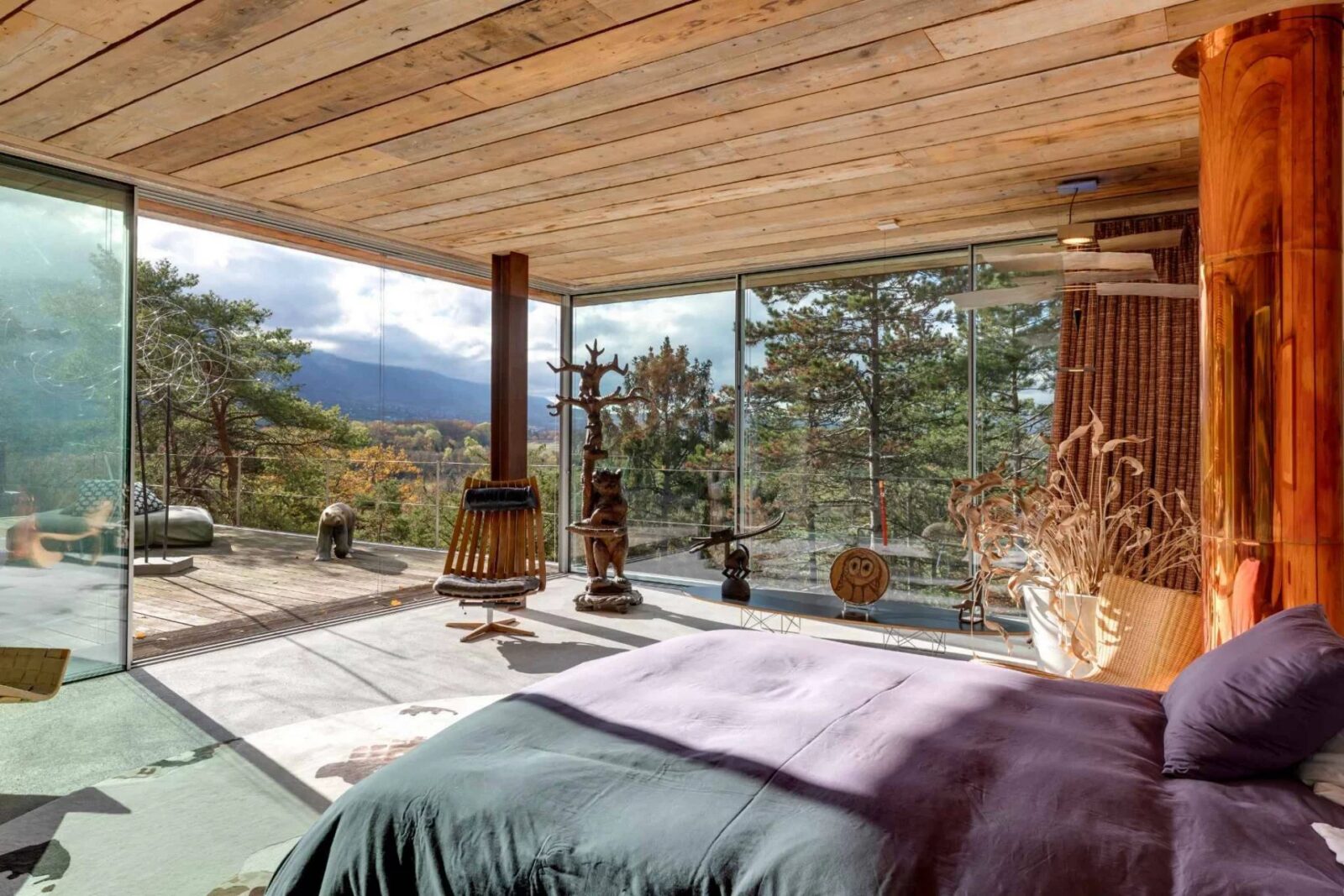

More luxury properties can be found in the storybook ski resorts in the Swiss Alps. Upscale Gstaad, Verbier, St. Moritz, Crans-Montana and Grimentz continue to attract international buyers.

“Prime property can range from US $13,400 (CHF 11,450) per square meter in an upcoming yet attractive resort such as Grimentz, all the way up to US $41,000 (CHF 36,100) per square meter in Gstaad,” Epiney says. Gstaad, with the most expensive resort properties, is the Aspen of Switzerland. A record-setting recent sale went for US $80,000 (CHF 70,400) per square meter.

The most expensive sale in 2023 was an under-the-radar purchase of a property in the Geneva area for US $120.36 million (CHF 106 million). Trailing the nine-figure transaction was an 18th-century castle and accompanying forest that sold for US $73.2 million (CHF 64.46 million) in Céligny, near Geneva. “The details of the interior, number of rooms and so on has remained confidential, yet it was recorded as one of the highest transactions historically for a residential property,” Epiney says of the castle property.

The surge of Covid buying in 2021 and 2022 has ended in Switzerland, but the pandemic changed buyer expectations. There’s more desire for outdoor spaces as well as suburban or countryside properties with a garden, a change since pre-Covid days, he says.

What will the rest of 2024 bring? “We expect to see a continued yet moderate increase in prices, supported by a strong Swiss economy, limited inflation and probable increases in the cost of construction materials,” Epiney says.

Risks that may affect luxury home sales include expanding conflicts around the world and the prospect of a new financial crisis linked to the record volume of vacant office spaces worldwide that are financed by major banks.

Beyond those factors, Epiney says the European and Swiss economies remain strong in the face of turbulence. Stabilized interest rates will help the overall market in 2024, indicating a probable increase in sales over 2023.